Attorney Fee Structured Deferrals: Case Study Analysis

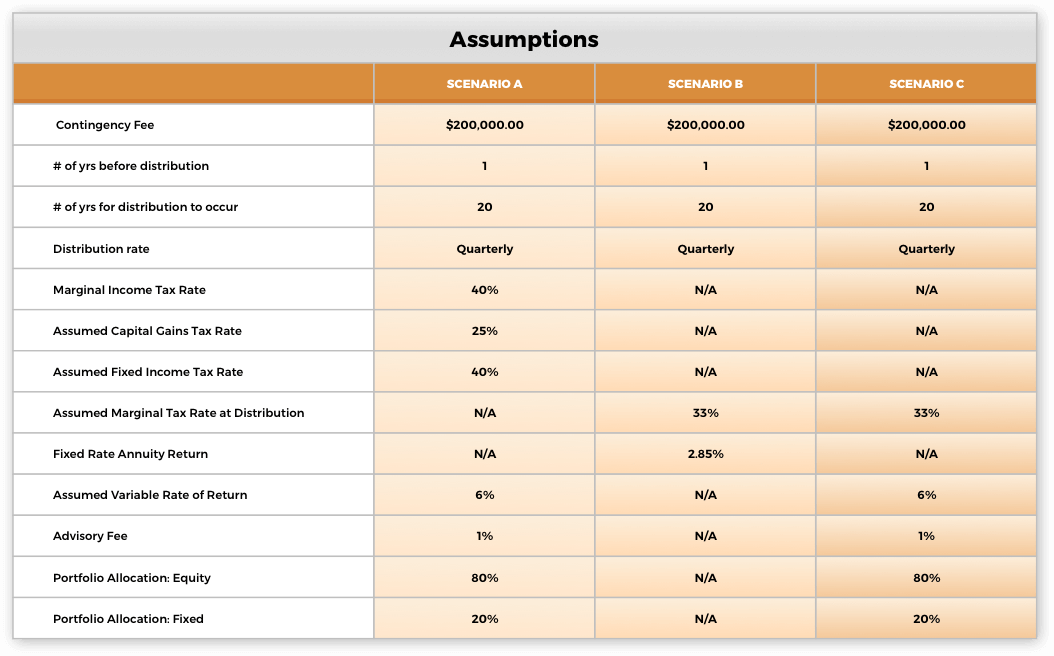

To continue our conversation on Attorney Fee Structured Deferrals from our last blog post, I’d like to compare a few options that an

attorney has at his/her disposal when deciding what to do with their

contingency fees. The different scenarios that we will look at are as follows:

Scenario A: Take as a lump-sum and

invest into an individual taxable account

Scenario B: Attorney

Fee Structured Deferral – Fixed option

Scenario C: Attorney

Fee Structured Deferral – Variable (market-based) option

See

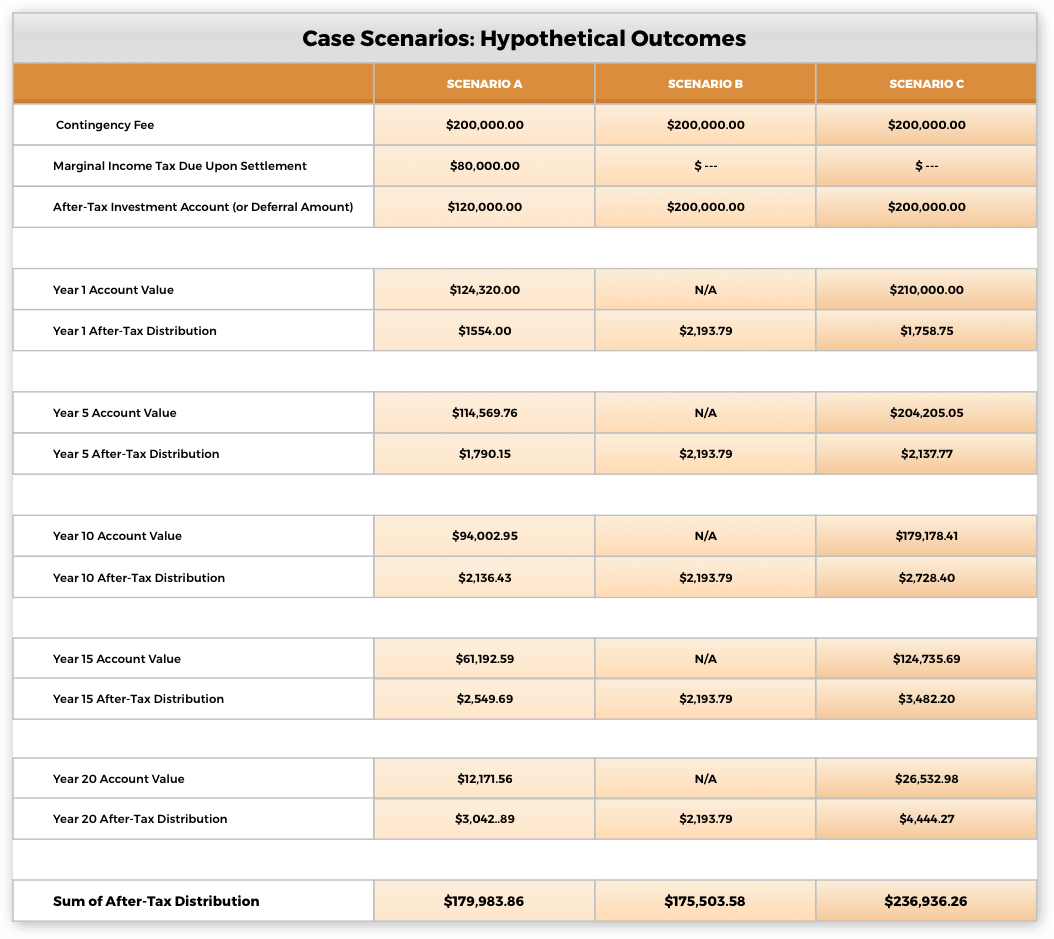

below for the outcomes for each of the above scenarios. Please note that distributions for each of these scenarios were made

on a quarterly basis; however, for the sake of saving space, we are

only displaying account value & after-tax quarterly distributions at 5-year increments.

As you can see, Scenario C (the market-based option) seems to outperform the other options when comparing the sum of after-tax distributions over this 20-year period. While we are not here to debate whether or not the market will provide you a 6% return – we are here to point out the benefit that an attorney can gain when choosing to defer taxes on their fees. When you start out with $200,000 and you have to pay taxes before you invest it, you are losing a good chunk of money that could have been invested – time in the market always beats market timing.

To another point – while Scenario B (Fixed option) grows tax deferred, the low

rate causes it to fall into last place in our case study when comparing the sum

of after-tax distribution. However, if you are someone that is low risk & values guaranteed returns,

Scenario B is a great option. It is also worth noting that the outcome of Scenario B (Fixed option) is not that much less than Scenario A (Lump sum into Taxable Account) - which really points to the value of deferring taxes.

Finally, with all of the above options/scenarios – depending on the program (or

product) you go with & the institutions associated with it, there will be

varying nuances & customizations that you will want to explore further. To

help you better plan your future and navigate this space, do not hesitate to contact us.

Recent Articles

2020 Impact: Financial Futures

4 years ago

2020 MAY HAVE YOU RE-THINKING YOUR FINANCIAL STRATEGY FOR THE FUTUREComparison: Settlement Recipient vs. Lottery Winner

7 years ago

Whether someone comes into a large windfall of money from a personal injury settlement or winning the lottery, both instances force the individual to make a decision – lump-sum or periodic payments?Critical Benefits of a Structured Settlement to the Injured Party

7 years ago

Structured Settlements are a great tool to help plaintiffs generate a periodic payment stream from their settlement award. Specific to personal injury plaintiffs, there are several benefits & advantages of choosing to structure one's settlement money.Attorney Fee Structured Deferrals: Things to consider

7 years ago

In this article, we flush out exactly why attorneys are even allowed to defer their fees & discuss some of the important items to consider when moving forward with an Attorney Fee Structured Deferral.